The Central Bank of Nigeria (CBN) has pledged to increase the figures of bank customers enrolled on the Bank Verification Number (BVN) portal from over 40 million to 100 million in by 2024.

According to the CBN Update released recently, the apex bank said increase in BVN enrolment would address the constraint that poor identification has on the availability of credit to prospective banking customers, particularly, those in the informal sector.

According to recent figures released by Nigeria Interbank Settlement Systems (NIBSS), over 40 million active banks accounts are currently linked with BVN and the CBN has pledged to increase the figures within the next five years through its proactive measures.

The BVN project, which captures the uniqueness of every bank customer, is one of the most-innovative projects introduced into the Nigerian financial system in 2014.

With 40 million bank accounts already linked to the BVN, the Bankers’ Committee has also unveiled a new plan that required classification of BVN into two – BVN Premium and BVN Lite.

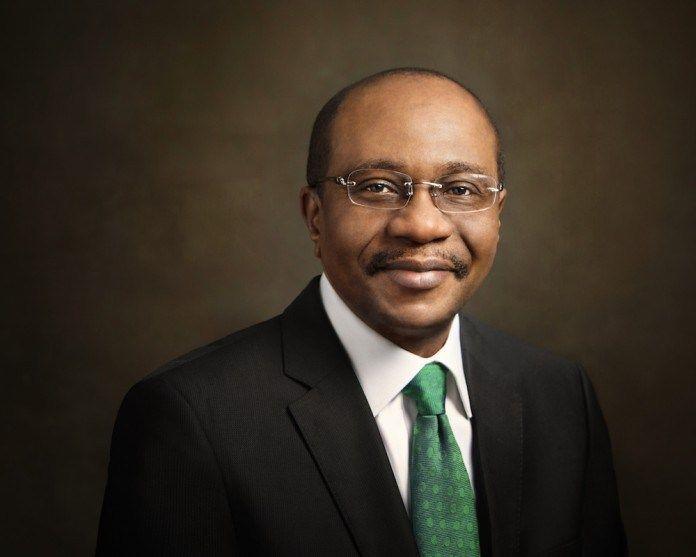

Central Bank of Nigeria (CBN) Governor Godwin Emefiele, said BVN Premium will cover customers that can provide the 18 basic requirements for a complete BVN enrolment, while the BVN Lite will require minimal documentation like name and phone number for bank customers, especially those in the rural areas that do not meet the full requirements.

This, he said, would enable such grassroots’ customers, mainly the poor, conduct minimal financial services and reduce financial exclusion rate.

The BVN scheme, which gives each bank customer unique identification, is to revolutionise the banking and payment systems while ensuring safety of depositors’ funds.