In Nigeria, the active bank accounts linked to Bank Verification Number (BVN) has reached 41.82 million in the last six years, the Nigeria Interbank Settlement System (NBISS) has shown.

Although the BVN data is less than the Central Bank of Nigeria’s (CBN’s) target of 100 enrollment in the next five years, but was an improvement from about 38 million captured in May 2019.

The CBN, Banker’ Committee in collaboration with all banks in Nigeria had on February 14, 2014, launched a centralized biometric identification system for the banking industry tagged BVN.

The purpose of the project was to use biometric information as a means of first identifying and verifying all individuals that have account(s) in any Nigerian bank and consequently, as a means of authenticating customer’s identity at point of transactions.

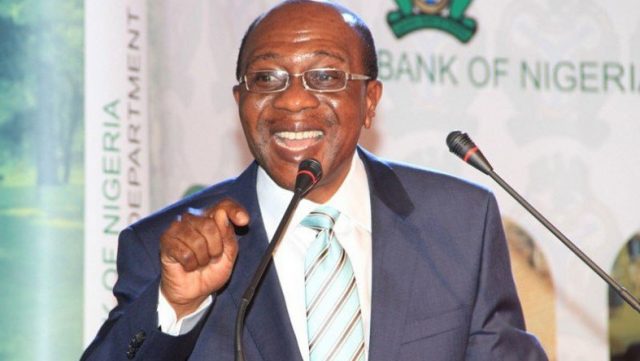

The CBN Governor, Godwin Emefiele said increase in BVN enrollment would address the constraint that poor identification has on the availability of credit to prospective banking customers, particularly, those in the informal sector. The need to get more people into the financial system, has prompted the CBN and Bankers’ Committee to unveil new BVN plan that required classification of BVN into two – BVN Premium and BVN Lite.

Emefiele, said BVN Premium will cover customers that can provide the 18 basic requirements for a complete BVN enrollment, while the BVN Lite will require minimal documentation like name and phone number for bank customers, especially those in the rural areas that do not meet the full requirements.

This, he said, would enable such grassroots’ customers, mainly the poor, conduct minimal financial services and reduce financial exclusion rate.

The BVN scheme, which gives each bank customer unique identification, is to revolutionise the banking and payment systems while ensuring safety of depositors’ funds.

The new BVN rule demand that the Know Your Customer (KYC) scheme would be migrated into the BVN Lite. “However, there are people who are currently financially excluded, like people in our rural communities that carry phones, but not having financial services. With the collaboration of National Communication Commission, we are putting this BVN arrangement to allow them conduct minimal financial services.”

Many commercial banks have adopted new strategies to reduce the large crowds at their branches, which are still opened in phases. The banks are each week sending emails and text messages to their customers informing them about the branches that will be in operation, everyday of the week after the the lockdown was relaxed.

In many of the banks’ branches, canopies and chairs are set up outside the bank’s premises for customers to sit while waiting to be attended to. In many of the commercial banks, from GTBank, FirstBank, Access Bank, Union Bank, Keystone Bank, among others, there were large customer presence in the branches, which the banks said they were addressing.

In emailed notice to its customers, GTBank said it will for now, be alternating the opening of its branches every week. It said customers will be advised on a weekly basis of the branches open to serve them.

“As we look forward to the month of June, we will continue to take the necessary precautions to keep our banking environments safe whilst providing you with the best banking experience”. Continuing, it said: “When visiting any of our branches, kindly protect yourself by wearing a facemask at all times. It is also very important that you keep a safe distance when in a queue inside or outside the branch”

The bank have also continually asked their customers to use e-payment channels and avoid physical presence at the branches. Aside those opening new accounts, there are others making cash withdrawals and deposits.

Also, in emailed note to customers, Access Bank Plc, said 2020 has redefined how people live and do business amidst the COVID-19 pandemic; utmost safety is the new normal. “Fortunately, with the improvements on our mobile, internet banking, USSD (*901#) and PrimusPlus, most of your everyday financial transactions can safely be completed from the comfort of your home using your computer or phone,” it said.

The bank said it has put all necessary measures and hygiene procedures in place to ensure your safety and that of our staff while transacting at our branches. “As the government relaxes the restriction on movement, please remember to stay masked-up, wash your hands often and continue to adhere to health and safety guidelines as mandated by health authorities. We reiterate our commitment to providing you with the highest level of service excellence always,” it said.

An insider source within the bank, said most of the customers that trouped to the branches did not have ATM cards and needed to get one having realized how badly they needed it in the COVID-19 era,” the bank said.

The Enhancing Financial Innovation & Access (EFInA) survey showed that 63.6 per cent of Nigeria’s adult population now has access to financial services and only 36.6 per cent are financially excluded.

According to the survey, many Nigerians, for numerous reasons are unbanked and lack access to formal financial services. Evidence worldwide shows that access to financial services contributes both to economic growth and wealth creation and is therefore key to tackling the ‘poverty’ trap in Nigeria. It is critical for regulators and policy makers to create an enabling policy environment to actively promote both the demand for and the supply of financial services to the unbanked and under-banked.