The Central Bank of Nigeria (CBN) has announced N50 billion special mechanism fund for reviving the Textiles Industry. The fund, which will be administered by Bank of industry (BOI) at 4.5 per cent interest rate using any of the CBN- approved non-interest financing instruments for refinancing of existing projects, long term financing for acquisition of plant and machinery and working capital for the beneficiaries.

The guidelines for the new fund- ‘Central Bank of Nigeria Non-Interest Guidelines For Intervention In the Textile Sector’ released yesterday was signed by CBN Director, Financial Policy and Regulation Department, Kelvin Amugo.

The apex bank said the fund will be used to resuscitate ailing textile sector, restructuring of existing facilities and provision of further facilities for textile companies with genuine need for intervention.

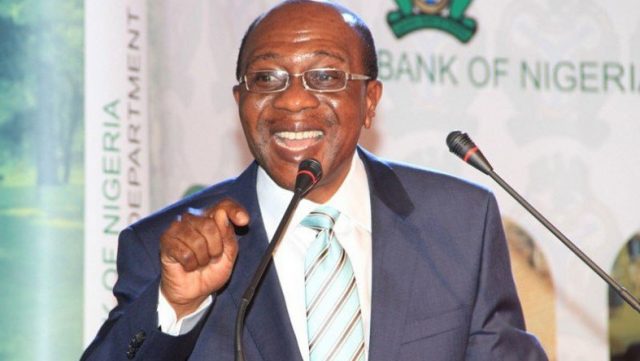

According to the apex bank, the seed fund which is a one-off intervention will terminate by December 31, 2025 with the maximum financial amount pegged at N2 billion for a single obligor in respect of new facilities and N1 billion for refinancing. The regulator disclosed that the plan to turnaround the textile sector was perfected at August 7, meeting between the CBN Governor, Godwin Emefiele and owners of textile mills in Nigeria.

The resolutions reached were at the meeting were that the Textile Mills articulate the status of their Bank of industry (BOI) Cotton Textile and Garment (CTG) Loans stating their outstanding loan balances, tenure, interest rate, interest payment and the assistance being sought from CBN.

The CBN listed activities to be covered under the Intervention as operations in the CTG value chain include cotton ginning (lint production), spinning (yarn production),textile mills, integrated garment factories (for military, para-military and schools and other uniformed institutions).

The eligibility criteria for participation in the scheme indicated that any textile company with an existing facility in the books of BOI under the CTG scheme, any textile company with existing facilities in Deposit Money Banks /Non Interest Financial Institutions (NIFIs), textile companies that are not participating under the Small and Medium Enterprises/Restructuring/Refinancing Fund (RRF) are qualifies while projects financed before June 2009 (inception of the BOI CTG Loan) shall not be eligible to participate.

It said emphasis will be on facilities that are indicating weakness arising from tenor, structure as well as facing cash flow difficulties. Further modalities for the facility showed that the fund will be administered at an all-in rate of return of 4.5 per cent per annum payable on quarterly basis.

The BOI, which is the managing agent, shall receive one per cent service charge from the return proceeds and remit 3.5 per cent to CBN. The facilities shall have a maximum tenor of 10 years and or working capital facility of one year with provision for a maximum roll over of three years. The intervention allows for a maximum moratorium of two years in the facility repayment schedule.

According to the rule for accessing the fund , existing benefiting companies are expected to submit requests to BOI for consideration on case by case basis while the BOI’s consideration of the applications shall be subject to approval by the CBN.

Also, each request for refinancing must be accompanied with request from Deposit Money Banks (DMBs) seeking to transfer the facilities to BOI, three years financials including the latest management account of the obligor and copies of duly executed offer documents between the bank and the obligor evidencing existence of a facility.

Within 14 days of the receipt of the banks’ requests, BOI shall inform the companies of the status of their application and also advise each company of the amount of its facility that shall be refinanced BOI shall forward the applications to CBN for approval and release of funds.

For the effective implementation of the Intervention and for it to achieve the desired objectives, the CBN is to articulate clear modalities for the implementation of the intervention, provide fund for the intervention and determine the limits of the fund.

The BOI is to restructure/refinance existing facilities, finance projects using any of the CBN- approved non-interest financing instruments such as Murabahah (cost plus mark-up sale) for acquisition of plant and machinery. Others are Ijarah (lease-to-own); Istisna’ (manufacture/construction and sale) and diminishing Musharakah (diminishing contractual partnership) for asset acquisition and working capital financing.

The BOI is also expected to put in place appropriate institutional arrangements for appraising, disbursing, monitoring and recovering the amount obtained under the intervention.