The Payment Services Banks (PSBs) were a year go licensed by the Central Bank of Nigeria (CBN) to enhance access to financial services for low income earners and unbanked segments of the market at the grassroots through digital services.

Three key operators, Hope PSB, a subsidiary of Unified Payment, Globacom’s Money Master and 9Mobile’s 9PSB need to do more in reaching the unbanked and underbanked.

It is one year since the Central Bank of Nigeria (CBN) gave a nod to telecom operators to offer mobile money services.The regulator granted final licences to three Payment Service Banks (PSBs) to start operation.

The apex bank in August last year issued Approval-in-Principle (AIP) to Hope PSB, a subsidiary of Unified Payment, Globacom’s Money Master and 9Mobile’s 9PSB.

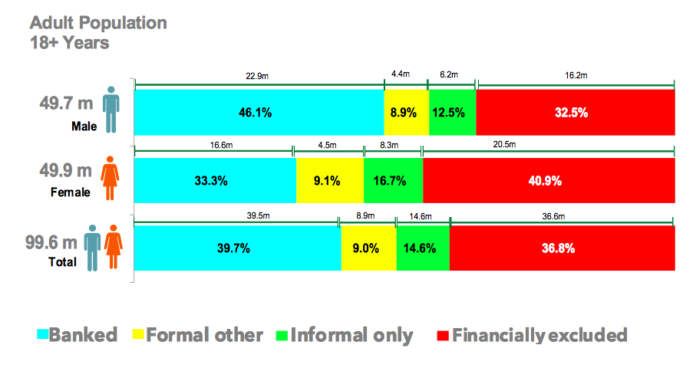

With financial inclusion seen as the quickest way to lift people out of poverty, stakeholders are anxious that rollout of the PSBs should start in earnest without further delay.

Since the license were granted, the operators have launched new products and services to bring financial services closer to the people.

For finance, Hope PSBank has assured customers-unbanked, underserved and banked of its readiness to deliver seamless digital banking experience to them as part of efforts targeted at promoting and driving financial inclusion in the Nigerian banking ecosystem.

Former Executive Director at Keystone Bank and expert in mobile money services, Richard Obire, said the players should strengthen the financial inclusion and offer reduced cost services.

He said evidence worldwide shows that access to financial services contributes to growth and wealth creation.

“For me, there is no time to waste. The new entrants are already providing similar services before the official licensing and should hit the ground running immediately. I also expect them to increase their transaction volumes and offer affordable services to the people,” he said.

CBN Director, Financial Policy and Regulations Department, Kelvin Amugo, said the PSBs were licensed to enhance access to finial services for low income earners and use technology to reach Nigerians in remote places where commercial banks find it difficult to operate.

According to the CBN guidelines, the PSBs are to offer smaller-scale banking operations and the absence of credit risk and foreign exchange operations.

In addition to operating current and savings accounts they can also offer payments and remittance services, issue debit and prepaid cards, deploy Automated Teller Machines (ATMs) and other technology-enabled banking services to the people, majority of whom cannot be reached by the conventional banks.

The PSBs are to facilitate high volume low-value transactions in remittance services, micro-savings and withdrawal services in a secured technology-driven environment to further deepen financial inclusion.

With N5 billion minimum capital requirement, the apex bank also authorised PSBs to sell foreign currencies (forex) realised from inbound cross-border personal (remittances) to licenced foreign exchange dealers.

“PSBs shall have the privilege to make their investments from the CBN window. All funds in excess of the PSB’s operational float should be placed with DMBs. PSBs shall participate in the payment and settlement system and have access to the inter-bank and the CBN colateralised repo window for its temporary liquidity management,” it said.

“PSBs shall render quarterly returns indicating the number of financially excluded customers on-boarded during the quarter to which the returns relate. All PSBs shall be required to interface with the Nigeria Inter-bank Settlement System (NIBSS) platform in order to promote interconnectivity and interoperability of operations within the Nigeria banking system,” its said.

The CBN, in furtherance of its mandate to promote a sound financial system in Nigeria and the need to enhance access to financial services for low income earners and unbanked segments of the society, has instituted the Payment Service Bank.

The key objective of setting up PSBs is to enhance financial inclusion by increasing access to deposit products and payment/remittance services to small businesses, low-income households and other financially excluded entities through high- volume low-value transactions in a secured technology-driven environment.

The PSB are to operate mostly in the rural areas and unbanked locations targeting financially excluded persons, with not less than 25 per cent financial service touch points in such rural areas as defined by the CBN from time to time; enter into direct partnership with card scheme operators.