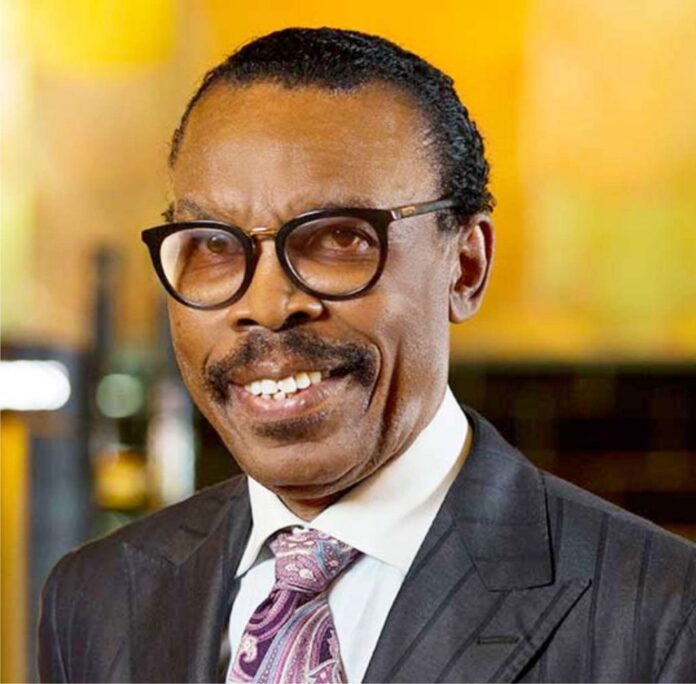

Member, Presidential Economic Advisory Council, Bismarck Rewane has said the Central Bank of Nigeria (CBN) printed approximately N400 billion new notes following the naira redesign programme.

In a report released yesterday titled: Nigeria Hits A Brick Wall, he said a shortfall of N2.48 trillion cash shortfall exists in the economy, leading to near paralysis of commercial activities in the country.

He said the shortfall represent 90 per cent of the cash in circulation.

According to Rewane, who is the Managing Director, Financial Derivatives Company Limited, total money supply stood at N52 trillion,.

He disclosed that three of the eight naira denominations- N200, N500 and N1,000 estimated at N2.88 trillion make up 90 per cent total cash in circulation.

Rewane said Nigeria’s Gross Domestic Product (GDP) size remains at $504.23 billion, with informal sector at 30 per cent of the GDP and worth $151.27 billion.

He said informal sector transactions settled by cash is worth $5.14 billion while velocity of circulation in the informal sector is 29 times.

According to him, reduction in the velocity of money will lower output in the informal sector.

“The informal sector accounts for 30 per cent of formal GDP. It employs over 80 per cent of the total population. Transactions are mainly settled in cash and Point of Sale (POS). There is a linkage between the informal and formal economy,” he said.

He said the Federal Government , with the best intentions, decided to redesign the naira at the most inauspicious time.

He said the policy has brought chaos and the unintended consequences.

“We are 12 days away from a monumental presidential election, and Nigerians are battling scarcity (fuel, cash & forex). Not only are these essential items in short supply, the queues and exorbitant prices accompanying them have worsened the cost-of-living crisis. While inflation dipped in December to 21.3 per cent, it is still at its highest level since 2005 and could be higher in the near term,” Rewane said.

According to him, consumers are not the only ones feeling the pinch.

He said retailers are confused, investors are bewildered, and unsurprisingly, policymakers are supposedly helpless, evidently now stuck between a rock and a hard place.

Also, private consumption, which contributes 70 per cent to GDP, is squeezed, and investment inflows, already downhill, could fall further as the crisis of confidence persists.

“The macroeconomic impact of the downtime due to ATM queues, petrol queues and the cash crunch could result in a contraction of three to five per cent of GDP in first quarter of 2023,” he said.