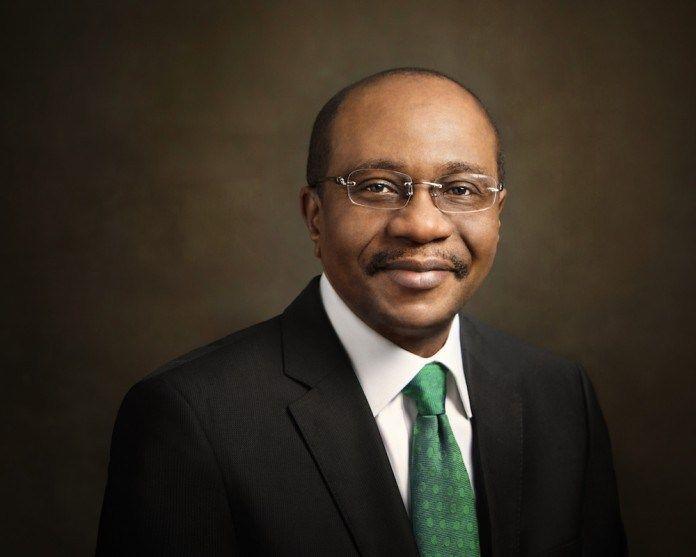

Monetary policy measures need accompanying support from non-oil sector to lift the economy, Central Bank of Nigeria (CBN) Governor, Godwin Emefiele announced yesterday.

He said countries all over the world are turning to export earnings and proceeds repatriation as a veritable means of bolstering foreign reserves, maintaining a robust Balance of Payments position, and a stable source of foreign exchange inflows.

Speaking at the third biannual non-oil export summit in Lagos with theme: “RT200: Challenges and Prospects to Success”, he said that in the case of Nigeria, developing the non-oil export sector is absolutely an imperative, given that this holds vast potential for generating a significant amount of foreign exchange earnings.

Emefiele admitted that the challenges facing the country today are many and evolving. He also threatened to sanction shipping companies exporting undocumented cargoes from the country.

These challenges require the enactment of unconventional, innovative, supportive and complementary macroeconomic policy actions that are inclined towards a market- based financing system.

He said now is the time for all of us to work together to reposition Nigeria on a sustainable growth trajectory by taking diversification of the economy seriously.

He said that unfolding global economic development suggests that monetary policy was reaching its limit and would need complementary help from other spheres of the economy to propel for sustainable growth.

He said some of these innovative ideas needed to support monetary policy decisions could spring from deep system thinking and powered by technology to engender growth and rapid transformation.

He said the CBN’s Naira-for-Dollar and RT200 initiatives are all attempts in that direction, to drive long-run economic development.

Emefiele said the RT200 programme has made good progress in export proceed repatriation since its establishment in February 2022.

“Available data shows that repatriation due to the programme increased by 40 per cent from US$3.0 billion in 2021 to US$5.6 billion at the end of 2022. The momentum for 2023 is equally showing strong numbers and impressive prospects,” he said.

The CBN boss added that the first quarter of 2023, a total of US$1.7 billion was repatriated to the economy while about $790 million was sold at the Investors’ & Exporters window year-to-date. The balance of the proceeds remained in the Export Domiciliary Accounts of exporters.

He said that proceeds not sold at the I&E window cannot and will not be eligible for the rebate adding that names of exporters who receive the rebate will be published going forward.

“So, we encourage holding their export proceeds in their domiciliary accounts to take advantage of the rebate by selling the at the I&E Window. We are committed to strengthening and expanding foreign exchange supply into the market,” he said.

“Naturally, you all are important in this clarion call of expanding the supply of foreign exchange inflow into the economy. For exporters, flying the flag of Nigeria in the international market, the Bankers’ Committee and the CBN stand ready to partner with you to achieve your goals. You can benefit from the many financial programmes introduced by the CBN through your bank and as such grow your business exponentially,” he said.

He said the theme for the programme was carefully selected to review the progress made so far, from inception of the RT200 programme in the first half of 2022 to date.

He said the summit provides a platform to deliberate on how to accelerate the value and volume of Nigeria’s Non-oil exports and ensure that proceeds therefrom are utilised most optimally for the benefit of our economy.

He said that in some countries, the period of repatriation ranges from less than six months from exportation of the product and could result in prosecution if proceeds are not repatriated on time.

Emefiele disclosed that the CBN in collaboration with the Bankers’ Committee identified the RT200 programme and export promotion in general as a critical tool for attaining sustainable and stable external balance and safeguarding the value of our local currency.

He explained that if a nation continues to consume more than it produces, imports more than it exports, such nation is destined to fail as there will be no meaningful development of any nation without harnessing its export sector potentials for the good of the nation.

In the case of Nigeria, he said that developing the non-oil export sector is absolutely an imperative, given that this holds vast potential for generating a significant amount of foreign exchange earnings.

Emefiele admitted that the challenges facing the country today are many and evolving.

These challenges require the enactment of unconventional, innovative, supportive and complementary macroeconomic policy actions that are inclined towards a market- based financing system.

He said now is the time for all of us to work together to reposition Nigeria on a sustainable growth trajectory by taking diversification of the economy seriously.

According to him, in Ghana for example, export earnings must be repatriated to the country, at least 40 percent of which must be converted to the domestic currency within 15 working days of repatriation. Exporters may hold the remainder in a Foreign Exchange Account (FEA).

In India, the Foreign Exchange Regulation Act permits realisation and repatriation of the export proceeds within nine months from the date of export. For any export to a warehouse established outside India, with the permission of the Reserve Bank of India, export proceeds can be repatriated within 15 months from the date of shipment. Many countries of the world have these requirements to ensure effective export repatriation.

“There is no better time than now to synergise for the benefit of our nation, as we implement a coordinated policy agenda that will support the economy and improve the economic activities,” he said.