The 2023 EFInA Access to Finance (A2F) Survey results launched in Lagos shows the Northern Nigeria has the least access to financial services.

The report disclosed that exclusion from financial services continues to be most severe in Northern Nigeria, at 38 per cent in the North East and 47 per cent in the North West compared to only five per cent in the South West and 10 per cent in the South South.

The A2F survey is Nigeria’s primary source of financial inclusion data and is designed to assess access to and use of financial services for the adult (18+) Nigerian population. The methodology for the 2023 survey has been updated to reflect changing population dynamics, and 2018 and 2020 data also updated using the same methodology to enable comparison.

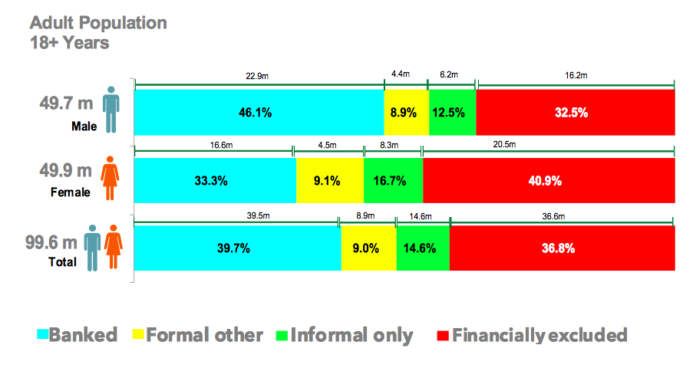

The 2023 results show that 26 per cent of Nigerians are financially excluded, down from 32 per cent in 2020, demonstrating clear progress towards the Nigeria Financial Inclusion Strategy (NFIS 3.0) recommended target to reduce levels of financial exclusion in Nigeria to 25 per cent by 2024.

The report said usage of broader financial services remains limited demonstrating the urgent need to focus on the quality and impact of inclusion. While credit use doubled to is six per cent, pension and insurance use remained at eight per cent and three per cent respectively, well below 2024 target levels.

It said that although formal inclusion is growing, from 56 per cent in 2020 to 64 per cent in 2023, but those accessing formal financial services through banks increased much more slowly, from 51 per cent to 52 per cent.

It said growth in formal inclusion is being driven by the increased use of non-banking channels, which grew from five per cent in 2020 to 12 per cent in 2023.

Despite growth in access, certain demographic gaps continue to persist in Nigeria. There was growth in women’s financial inclusion from 60 per cent in 2020 to 70 per cent in 2023 despite an increase in the gender gap from eight per cent recorded in 2020 to nine per cent in 2023.

However, with formal financial inclusion levels at only 64 per cent (up from 56 per cent in 2020), there remains significant work to do in order to achieve the ambition of the Central Bank of 95 per cent formal inclusion in the long term.

Commenting on the results of the Survey, EFiNA Chair Dr Agnes Martins said: “We are seeing encouraging progress towards the NFIS 3.0 recommended goal to reduce exclusion to 25 per cent by 2024, and we must acknowledge all the good work that has gone into making this happen. However, we also have to be clear that 26 per cent exclusion means that 28.8 million adult Nigerians continue to be completely excluded from the financial system.

“That is a statistic that we must recognise remains unacceptable, and we must redouble our efforts to accelerate their inclusion. These are predominantly farmers and dependents, more likely to be female, and to live in rural areas in Northern Nigeria. We need intentional, deliberate strategies to give them financial access and to support them graduate to the products and services that can enhance their resilience. Over the coming weeks we will be engaging all stakeholders to further analyse the data and work collaboratively to develop solutions.”

Speaking at the event, Governor of the Central Bank of Nigeria (CBN) Yemi Cardoso said Nigeria’s drive for financial inclusion has been a long, sometimes arduous journey.

“We have monitored the trend over the years and have sometimes worried about the slow pace of progress in achieving an inclusive economy. The results being shared today, however, indicate that with sustained dedication and commitment, we can truly achieve our collective goal of financial inclusion for all,” he said.

Cardoso, who was represented by, CBN Director, Other Financial Institutions Supervision Department, Chibuike Nwagerue, lauded all financial inclusion stakeholders for the efforts made and the progress achieved.

“However, to achieve the target of 95 percent financial inclusion, we must all move from collaboration to concrete commitment. To that effect, I call on all Financial Inclusion implementation agencies to set up specific functions or units dedicated to financial inclusion in their various organizations. This we believe, will provide the necessary ownership and commitment required to achieve our collective goal,” he said.

“As an ecosystem, we must redouble our efforts to develop innovative solutions to enable inclusion and be intentional about how we do it. For instance, the access points effective for included populations might not be suitable for those currently excluded. The products and services that we have developed to get us this far will need refinement to ensure that they are fit for purpose for the next phase of this journey.”

According to him, the Nigerian financial system has evolved with significant improvements in size and depth, especially in the areas of market development, products, instruments, and payment infrastructure, among other things, thus, reinforcing the need for us as regulators and stakeholders to constantly keep pace with these emerging developments in a sustainable manner.

“Industry efforts have been galvanized over the past decade, and this has led to a steady increase in Financial Inclusion in Nigeria,” he said.

He said that over the last 15 years, the proportion of formally served adults has more than doubled from 24 per cent recorded in 2008 to 64 per cent in 2023.